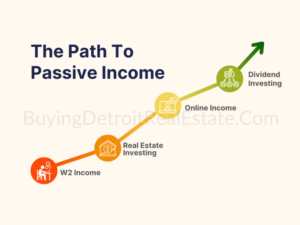

In today’s fast-paced world, many are seeking ways to grow their wealth without the need for constant active involvement. This desire has led to the rise of passive income — money earned with minimal effort after an initial investment of time or capital. For those looking to build long-term financial security, passive income investment strategies can be an excellent path forward. But how do you get started? Let’s explore the world of passive income, its potential benefits, and the investment opportunities that can help you achieve financial independence.

What is Passive Income?

Passive income is money earned with little to no daily effort once the initial setup or investment is made. Unlike active income — where you trade time for money (like a salary or hourly wage) — passive income continues to flow in without requiring consistent, direct work.

The goal of passive income is to create revenue streams that operate on autopilot, allowing you to free up time while still earning money. While it might take significant effort or capital to set up initially, the potential returns can make it well worth the investment in both time and resources.

Types of Passive Income Investments

There are several types of passive income opportunities, each with varying levels of risk, required capital, and potential return. Here are some of the most popular passive income investments:

1. Real Estate Investment

Real estate has long been a reliable passive income source. When done correctly, property investments can generate consistent cash flow, appreciation, and tax advantages. Here are some common real estate strategies for passive income:

- Rental Properties: Owning rental properties allows you to earn regular income through rent payments. After purchasing the property, maintenance and tenant management can be outsourced to property managers, making this a relatively passive source of income.

- Real Estate Investment Trusts (REITs): For those who don’t want to manage properties directly, REITs are an excellent alternative. REITs pool money from many investors to invest in a diversified portfolio of real estate properties. These are typically traded on stock exchanges, making them liquid and accessible.

2. Dividend Stocks

Investing in dividend-paying stocks is one of the most popular ways to generate passive income. Many well-established companies distribute a portion of their earnings to shareholders in the form of dividends. By purchasing dividend stocks, investors can receive regular payments, often on a quarterly basis.

To start, you’ll need to research reliable, dividend-paying companies. These stocks can provide steady, long-term returns as the stock price appreciates while also offering dividends.

3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending is a relatively new way to generate passive income. With P2P lending platforms (such as LendingClub or Prosper), you can lend money to individuals or small businesses and receive interest payments in return. This is a riskier investment than stocks or bonds, but it can offer higher returns if managed carefully.

By spreading your investments across multiple loans, you can reduce your risk while increasing the likelihood of earning consistent passive income. Keep in mind that the borrower’s ability to repay loans and the platform’s reliability are key factors to success.

4. Online Content Creation

The digital age has made it possible for individuals to create passive income streams by sharing their expertise, creativity, and content. Here are a few ways to create passive income through content:

- E-books and Online Courses: Once created, e-books and online courses can generate revenue over time without further effort. If you have a valuable skill or knowledge in a specific area, this can be a highly profitable way to earn passive income.

- YouTube or Streaming: If you create engaging videos or content, platforms like YouTube and Twitch can generate advertising revenue through views and sponsorships.

- Affiliate Marketing: By promoting products or services on your website, blog, or social media, you can earn commissions whenever someone buys through your affiliate link.

5. High-Yield Savings Accounts and Bonds

If you’re looking for low-risk passive income, consider high-yield savings accounts and bonds. While the returns aren’t as high as stocks or real estate, they provide stability and guaranteed returns.

- High-Yield Savings Accounts: These accounts offer a higher interest rate than traditional savings accounts, allowing your money to grow slowly but steadily.

- Bonds: When you purchase a bond, you are lending money to a government or corporation in exchange for regular interest payments over time. Bonds can be a good option for conservative investors seeking predictable returns.

6. Index Funds and ETFs

Investing in index funds or exchange-traded funds (ETFs) is another excellent way to earn passive income. These funds track a particular market index, such as the S&P 500, and allow you to invest in a broad array of companies without needing to pick individual stocks.

Index funds and ETFs typically offer low fees and require minimal effort to manage, making them a great option for long-term, passive income. Over time, the value of these funds can grow as the underlying market increases, and many also pay dividends to shareholders.

The Benefits of Passive Income

- Financial Independence: The biggest advantage of passive income is the ability to generate money without having to trade time for it. This allows you to eventually achieve financial independence, where your passive income covers your living expenses and you no longer need a full-time job.

- Time Freedom: With passive income, you have more time to focus on other things that matter to you, such as pursuing hobbies, spending time with loved ones, or even starting new ventures.

- Diversification: Passive income investments allow you to diversify your portfolio, which can help protect against volatility in traditional income streams like salaries or wages.

- Scalability: Many passive income strategies, especially in areas like digital content creation or real estate, offer scalability. With the right strategy, you can grow your income significantly over time without a proportional increase in effort.

Things to Consider Before Investing in Passive Income

While the idea of earning passive income is appealing, it’s important to keep in mind that no investment is completely risk-free. Here are a few things to consider before diving into passive income investments:

- Initial Investment: Many passive income streams require an initial investment of either money or time. Be sure to evaluate the required upfront costs, whether it’s the capital for real estate or the time spent creating online content.

- Risk Tolerance: Each passive income investment comes with its own level of risk. Assess your own risk tolerance and make sure you’re comfortable with the potential for loss in some areas, such as P2P lending or stock market investments.

- Diversification: To mitigate risk, it’s wise to diversify your passive income streams. Relying too heavily on one source of income can leave you vulnerable to market changes or shifts in demand.

- Ongoing Maintenance: Some passive income streams, like rental properties or businesses, require ongoing maintenance and management. Even though they’re considered “passive,” there may be times when you need to put in effort to maintain or optimize your investments.

Conclusion: Taking the First Step Towards Passive Income

The journey to building passive income starts with a single step. Whether it’s buying your first dividend stock, investing in real estate, or launching a digital content project, taking that first step is key. Remember that passive income is a long-term strategy. You may not see massive returns overnight, but with patience, consistency, and smart choices, your investments can eventually create a steady flow of income that works for you.

Before getting started, do thorough research and consider speaking with a financial advisor to help you create a strategy tailored to your goals and risk profile. With the right approach, passive income can be a powerful tool to build wealth and achieve financial freedom.